Accounting for Startups The Ultimate Startup Accounting Guide

In the technology and biotech industries, early-stage companies that are playing for the big outcomes need to use GAAP accounting. Many inexpensive, non-CPA bookkeepers will simply do cash based accounting – which is likely fine for a small coffee shop or ad agency. But that’s not https://www.bookstime.com/ what the tech industry expects if you are “going big. Simple and easy to use financial model for technology startups looking to project revenue and expenses. However, if you want to take a stab at your accounting, read on to see tech startup accounting tips that you can follow.

The Right Accounting Partner for Your Startup’s Next Round

- Accounting software helps startups manage their financial transactions, track expenses, generate invoices, and maintain accurate records.

- Here’s a breakdown of what to consider when selecting the right software for your startup.

- The main reason you might consider buying QuickBooks Online is that most accountants are familiar with how it works.

- If you have two favorites but aren’t sure which to choose, consider signing-up for both and deciding which you prefer.

These firms take a comprehensive view of the technology landscape and apply the right solutions exactly where needed. All online accounting services simplify the accounting process, but there will undoubtedly be times when you have questions. Some apps provide context-sensitive help along best cpa for startups the way and a searchable database of support articles. Most are the type that any small business owner could customize, generate, and understand. Eight small business accounting applications scored high enough to be included in our list of the best small business accounting software.

Why We Chose QuickBooks Online

If you don’t legally need an audit but would still like an analysis of your financial records, you can opt to instead have a review, which is considered a moderate level of assurance. Here, your CPA can review your financial statements, research your startup’s accounting practices, and do an analytical dive in the hunt for errors. We look to partner with our clients, going beyond the typical outsourced accounting relationship and seeking to provide a higher level advisory role. We feel honored to be a part of making the world a better place, even if it’s one debit and credit at a time. Tax credits are a dollar-for-dollar reduction in a tax, and a business can deduct the credit directly from taxes owed when certain conditions are satisfied. Kruze Consulting has conducted over 1,000 R&D tax credit studies that have saved our clients over $40 million in burn.

A CPA Firm Specialized in Startup Accounting & Finance

- We have former VCs on staff to help prepare you for your next funding round, and former IRS agents on hand to assist you as you think through the tax ramifications of selling your company.

- After entering your bills in accounts payable, track them weekly to make sure that they’re paid on time.

- While you may not keep physical checks anymore, be sure that you keep your bank statements handy so you can determine if a check has cleared and, if so, request a copy of the check to give your supplier.

- When I clicked on it, I was presented with a simple form to toggle on and off the widgets I wanted on the dashboard.

- Use our map below to find out your IRS and local filing schedule based on your startup’s location.

- Many startups have significant expenses before they become profitable, and as a result, can accumulate net operating losses and tax credit carryovers.

- Certified Public Accountants (CPAs) do a lot more than just bookkeeping and taxes.

To get the best possible experience please use the latest version of Chrome, Firefox, Safari, or Microsoft Edge to view this website. Sign up to receive more well-researched small business articles and topics in your inbox, personalized for you. We include the average user review score for each software collected from large third-party websites dedicated to the collection of user reviews, such as Software Advice, SourceForge, and G2. A good mobile app should be able to perform all the same functions as the computer interface. Sage 50cloud is desktop-based with a cloud-based hybrid functionality. It is truly a desktop application, but you use the cloud to back it up to store and save your data.

However, they say that using customizations requires a learning curve, and the price increases at each renewal, rendering the platform unaffordable for many small businesses in time. The software even allows a breakdown of tracked time based on billable and non-billable activities within each project or job. From there, you can track job progress based on its income, expenses and profit margin, then easily turn timesheets into invoices.

Which Is the Best Accounting Software?

- The features and functionality of any software are a major factor in whether it will serve the right purpose for your business.

- Credit card fraud is a real thing and can sneak up on you with a lot of small charges put through to see if you’re paying attention.

- Beyond just creating budgets, your accountant can help you with forecasting, analyzing key performance indicators (KPIs), and developing a financing strategy.

- This expense has nothing to do with profitability, or even revenue – you have to file if you are incorporated in DE.

- Danielle Bauter is a writer for the Accounting division of Fit Small Business.

- Instead of leading me to certain partner products, I would have preferred a menu item of available integration products so I could see what was available and choose the right one for my business needs.

Keep in mind that more than 80 percent of small businesses fail due to poor cash flow – and there are various complexities that young businesses need to be able to navigate to meet various requirements. We’re talking about necessary paperwork, investor and board reporting requirements, tax credits and incentives, research and development credits, tax laws and regulations, and regulatory standards among others. Depending on how well a business can manage these factors could either cause a business to sink or prosper. Selecting an experienced Certified Public Accountant (CPA) is a critical step for startups aiming to enhance their financial well-being and propel growth. A CPA with deep insights into the startup landscape can provide essential advice, ensure adherence to compliance regulations, and assist with strategic financial planning.

- We rate these applications primarily based on how easy they are to use, how much they do, and their price.

- I had an excellent experience working with the team at Kruze – from seed funding through acquisition of my company.

- It also offers strong budgeting functionality to assist with financial planning.

- The acquiring company realizes that they are dealing with a professional team of world-class accountants focused on serving startup clients.

- Others, such as Intuit QuickBooks Online and Xero, read the receipts and transfer some of their data (such as date, vendor, and amount) to an expense form using optical character recognition technology.

At its core, it offers dynamic invoicing capabilities allowing businesses to generate bespoke online invoices tailored to their specific requirements. This adaptability extends to bank connections, integrating with over 9,600 financial institutions across the U.S. and Canada. This ensures that businesses have a singular view of their finances, with the ability to review, edit and reconcile records efficiently. “Staying compliant with global tax regulations can be a challenge, but NetSuite simplifies this area considerably by ensuring things like calculating and remitting VAT are properly addressed without too much busywork. It also offers strong budgeting functionality to assist with financial planning.

References from existing clients

Forensic accounting

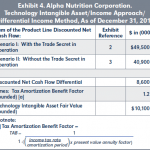

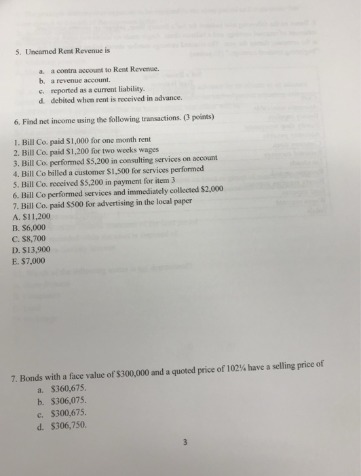

Forms 940, 941, 944 and 1040 Sch H Employment Taxes Internal Revenue Service

This blogpost only scratched the surface on IRS Form 941. There’s even more to know about the form, reporting schedules, corrections, and other forms and taxes that must reconcile with Form 941. Investing in a payroll resource guide can be an excellent way to keep up to date with all the changes and adjustments. Note that the IRS imposes penalties for late filing of Form 941, late payment of taxes, and failure to deposit the withheld taxes when they are due.

More In Forms and Instructions

The employer is required to file this form even if they have no employees working for the business during a specific quarter. For example, even when many businesses were forced to shut down due to government-imposed lockdowns during the pandemic, they were still required to file Form 941 quarterly. Experts recommend conducting a quarterly internal payroll audit, including an analysis of your payroll tax forms, to ensure payroll accuracy and minimize compliance errors. It’s the total tax you owe based on gross payroll minus tax credits and other adjustments for each month. Your tax liability for the quarter must equal the total on line 12.

- Form 944 generally is due on January 31 of the following year.

- Part 3 will ask if your business closed, if you are a seasonal employer, or if you stopped paying wages for any reason.

- The term legal holiday means any legal holiday in the District of Columbia.

- PEOs handle various payroll administration and tax reporting responsibilities for their business clients and are typically paid a fee based on payroll costs.

IRS Form 940 vs IRS Form 941: What’s the difference?

If this is a first-time penalty or you have a reasonable cause (such as a natural disaster or death in the family), you can also apply for penalty abatement with support from a tax professional. Note that being unaware of your tax obligations is not considered reasonable cause. The IRS is allowing businesses to defer payment Navigating Financial Growth: Leveraging Bookkeeping and Accounting Services for Startups of certain employment taxes as part of two tax credits introduced during the 2020 COVID-19 pandemic. Part 3 asks questions about your business, and Part 4 asks if the IRS can communicate with your third-party designee if you have one. This might be someone you hired to prepare your Form 941 or to prepare your payroll taxes.

Resources for Your Growing Business

Employers of agricultural employees typically file Form 943 instead of Form 941. To inform the IRS that your business will not be filing a return for one or more quarters in a given year due to no wages paid, you need to indicate this on Form 941. There is a box on line 18 of the form that you should check for each quarter in which you are filing but do not need to file for subsequent quarters. A paid preparer must sign Form 941 and provide the information in the Paid Preparer Use Only section of Part 5 if the preparer was paid to prepare Form 941 and isn’t an employee of the filing entity.

To tell the IRS that a particular Form 941 is your final return, check the box on line 17 and enter the final date you paid wages in the space provided. For additional filing requirements, including information about attaching a statement to your final return, see If Your Business Has https://virginiadigest.com/navigating-financial-growth-leveraging-bookkeeping-and-accounting-services-for-startups/ Closed, earlier. For 2024, the rate of social security tax on taxable wages is 6.2% (0.062) each for the employer and employee. Stop paying social security tax on and entering an employee’s wages on line 5a when the employee’s taxable wages and tips reach $168,600 for the year.

The frequency of making employment tax deposits can be semiweekly, monthly, or quarterly. If an employer reported more than $50,000 in taxes during the lookback period, the employer is a semiweekly depositor. There is also the next-day deposit rule, which applies to employers that accumulate federal taxes of $100,000 or more on any day during a deposit period. The total tax liability for the quarter must equal the amount reported on line 12. Don’t reduce your monthly tax liability reported on line 16 or your daily tax liability reported on Schedule B (Form 941) below zero. For tax years beginning before January 1, 2023, a qualified small business may elect to claim up to $250,000 of its credit for increasing research activities as a payroll tax credit.

If you’re filing your tax return or paying your federal taxes electronically, a valid employer identification number (EIN) is required at the time the return is filed or the payment is made. If a valid EIN isn’t provided, the return or payment won’t be processed. See Employer identification number (EIN), later, for information about applying for an EIN.

Part 1: Questions for the quarter

The resulting net tax after credits and adjustments is the amount of employment taxes you owe for the quarter (Form 941) or the year (Form 944). If this amount is $2,500 or more, and you’re a monthly schedule depositor, for either Form 941 or Form 944 complete the tax liability for each month in Part 2. If you file Form 941 and are a semiweekly depositor, then report your tax liability by date on Schedule B (Form 941), Report of Tax Liability for Semiweekly Schedule DepositorsPDF. If you file Form 944 and are a semiweekly depositor, then report your tax liability by date on Form 945-A, Annual Record of Federal Tax Liability.

Instructions for Form 941 – Notices

Fill out line 7 to adjust fractions of cents from lines 5a – 5d. At some point, you will probably have a fraction of a penny when you complete your calculations. The fraction adjustments relate to the employee share of Social Security and Medicare taxes withheld. The IRS is not known for straightforward fields, and this one is no exception. Enter the number of employees on your payroll for the pay period including March 12, June 12, September 12, or December 12, for the quarter indicated at the top of Form 941. Once you account for these items, you’ll end up with a total amount of money you will need to pay to cover your payroll tax responsibilities for the quarter.

Virtual Bookkeeping: How to Hire the Best Bookkeeper Online

Nav uses the Vantage 3.0 credit score to determine which credit offers are recommended which may differ from the credit score used by lenders and service providers. However, credit score alone does not guarantee or imply approval for any credit card, financing, or service offer. https://www.business-accounting.net/ Susan Guillory is an intuitive business coach and content magic maker. She’s written several business books and has been published on sites including Forbes, AllBusiness, and SoFi. She writes about business and personal credit, financial strategies, loans, and credit cards.

IgniteSpot Accounting

However, if you want more advanced reporting and a more robust mobile experience, you’re better off looking at other solutions on this list. Billy/Sunrise also got some bad reps for its choices regarding customer loyalty when it was acquired. Because every client and their needs vary so widely, we provide flexible, unique pricing for every client. Get in touch with one of our specialists today to get your quote or click here to get started. If you’re still on the fence about hiring a virtual bookkeeper, crunch some numbers to help reach a decision.

Compare runner-up bookkeeping service features

If you don’t have an accountant, you can opt to add tax filing to your subscription, and let Bench take care of taxes for you. At Bench, we give you a team of professional bookkeepers who do your bookkeeping for you. They automatically import all your business transactions, categorize them for you, and produce monthly and year-end financial reports.

Best Online Bookkeeping Services (

Each plan comes with a finance expert, automated transaction imports, P&L, balance sheet and cash flow statements. You’ll also get burn rate calculations, which is helpful for startups that need to closely track their spending. We evaluated whether the online bookkeeping service offered tax and consulting, and the scope of those services. 1-800Accountant is a nationwide virtual accounting firm that will handle all of your accounting needs, from bookkeeping to tax preparation and filing.

Virtual accounting FAQ

- Pilot is a finance, accounting, and tax services firm built for VC backed startups.

- The Premium plan ($399 a month if billed annually or $499 billed monthly) adds tax advising services, end-of-year tax filing, and financial strategy planning.

- Typically, the lower your expenses (and the fewer your accounting needs), the less you’ll be charged.

- You won’t need any other software to work with Bench—we do everything within our easy-to-use platform.

If you use QuickBooks Online, you can get easy access to QuickBooks-certified experts to help with your books. A QuickBooks Expert cannot begin cleaning up your past books until they receive the required supporting documentation, which your bookkeeper will request from you after your first meeting. Once your bookkeeper receives all the necessary documentation, they’ll typically complete your cleanup within 30 days. In some cases, your cleanup may take longer depending on timeliness of documentation and the complexity of your books.

The firm specializes in preparing personal and corporate taxation while providing fractional CFO work and leading the accounting and finance function for several small-to-medium-sized businesses. In his free time, you’ll find Jason on the basketball court, travelling, and spending quality time with family. You’ll likely need off-the-shelf accounting software in order to check your books and help your virtual bookkeeper categorize any transactions they’re unsure of. Be prepared to communicate mainly through email or messaging apps like Slack. The virtual bookkeeping providers above might be our favorite—but if they don’t quite fit your needs, we understand completely.

From there, you can add comprehensive accounting, payroll, and tax services as needed. Bookkeeper.com manages your accounts using QuickBooks Online (or QuickBooks Desktop, if you prefer). Plus, not every online bookkeeping service works with both accrual-basis and cash-basis accounting—but Bookkeeper.com does. Expert Assisted doesn’t include cleanup of your books or a dedicated bookkeeper reconciling your accounts and maintaining your books for you. Expert Assisted also doesn’t include any financial advisory services, tax advice, facilitating the filing of income or sales tax returns, creating or sending 1099s, or management of payroll.

Small business bookkeeping starts with the business, financial, or accounting software you use. If you haven’t yet selected accounting software, consider your budget, the program’s user experience, its features and reporting capabilities, and its scalability as your business grows. A bookkeeper provides critical services to keep your business finances in order. Small business owners and solo entrepreneurs may take on bookkeeping tasks themselves, but it can cost a lot in effort and time away from the heart of their business.

No matter how far behind you are (yes, even years behind), we can get you caught up quickly. A downside of Bench is that it specializes in cash-basis accounting, although there is a custom accrual accounting plan on the Pro plan. Then, consider how that time could be better spent on other aspects of your business—like getting new clients, developing new products, or enjoying some much-needed R&R.

If you use accrual-basis accounting, you’ll need the Growth plan, which starts at $990 a month. And the Executive plan, which is built for larger companies that need CFO services, has custom pricing. You’ll need to get in touch with an inDinero rep for a price estimate. https://www.business-accounting.net/the-difference-between-fixed-cost-total-fixed-cost-and-variable-cost/ Unlike most other outsourced bookkeepers on our list, Merritt Bookkeeping doesn’t offer any in-house add-ons for payroll and tax services. If you were hoping for a one-stop shop that can tackle all of your financial needs, Merritt might not be the right choice for you.

If your books are behind, we can get you caught up for $299 per month. Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. bank reconciliation statement definition Katherine Haan is a small business owner with nearly two decades of experience helping other business owners increase their incomes. Sign up to receive more well-researched small business articles and topics in your inbox, personalized for you.

These can be good signs that your bookkeeper knows what they’re doing. Although it might save money to do your business’ books yourself, you might have run into some of the downsides. It’s common to make mistakes, get behind on your books, or realize that you’ve been doing something incorrectly. Hiring a bookkeeper comes with an upfront cost, but it can save you a lot of time, energy, and effort when it comes to keeping your finances in good shape.

Bookkeeping is one of the many specialized tasks that business owners take on while they start and grow their businesses. If your monthly average is $10,001-50,000, the monthly price for Live Expert Full-Service Bookkeeping is $500. If your monthly average is $0-10,000 per month, the monthly price for Live Expert Full-Service Bookkeeping is $300.

For the vast majority of businesses, the job of bookkeeping is too small for a department but too much for the owner. Once you do the math, you’ll get an idea of how much you really spend on bookkeeping every month—even if you’re not cutting yourself a check for those services. If you’re a freelancer, try applying your hourly rate to the time you spend on bookkeeping. But virtual bookkeeping (also known as remote bookkeeping) comes with drawbacks as well as benefits. Let’s look at how virtual bookkeeping works, then figure out whether it’s a good fit for your business. Botkeeper is best for accounting firms that want to scale by automating bookkeeping tasks.

How to hire a bookkeeper for your small business

Bookkeepers will usually prepare relevant records and tax documents, and then forward this information to an accountant, who will then prepare the actual tax return. InDinero offers monthly, quarterly, and annual pricing but differs from the rest on our list because you have to talk to a salesperson to get an actual price. Merritt Bookkeeping has the most competitive pricing on our list and is the only one to offer a flat rate for all types of businesses. Unfortunately, if flexibility is what you’re looking for, Merritt Bookkeeping may not be for you since you can only import data from QuickBooks Online. If you’re looking for something very cheap and simple and your business is in its very early stages, the affordability of Merritt Bookkeeping makes it a good choice. For pricing, $210 a month gets you 5 hours of an administrative assistant to handle your books.

Best Online Bookkeeping Services of 2022 Reviewed

In the cleanup/setup phase, your bookkeeper helps you set up your chart of accounts, connects your banks, and teaches you the basics of QuickBooks. If you have information in QuickBooks already, your bookkeeper will help clean it up in the first month of service. After you’ve pared down the options to find a qualified, trustworthy bookkeeper who’s a good fit for your business, it’s time to sign the deal. The bookkeeper should have an agreement that clarifies exactly what services they’re providing, what you’re responsible for, and the terms of the relationship. Be sure to note what information you need to provide the bookkeeper and by when, as well as how you can terminate the agreement if needed. Before you select a bookkeeper, work with them to determine how much help you need.

How to hire a bookkeeper for your small business

When your business is still growing, bookkeeping isn’t such a cumbersome task. But as the business gets larger, it can start to become a very time-consuming job. When deciding whether to use online bookkeeping services, it’s best to consider the amount of time (and therefore, the amount of money) that you’ll save with accounting software and a dedicated bookkeeper. The best online bookkeeping services are affordable and easy to use, offer a wide range of bookkeeping solutions, and provide easy access to dedicated bookkeepers. Many of the top services also have add-on services, such as catch-up bookkeeping, payroll, and tax filing, which can streamline your work.

Want More Helpful Articles About Running a Business?

The best online bookkeeping services will provide you with as many services as you need — and none that you don’t need. It’s common for owners of small businesses to attempt bookkeeping on their own, but it’s easy for bookkeeping to become an afterthought until tax time approaches. Choosing the right bookkeeping services for your small business will also free up time for you to focus on your company, easing a lot of stress. Bookkeeper is one of the pricier business bookkeeping services on our list, but it comes with many possible add-on services.

Bookkeeper360: Best for hourly bookkeeping

With their Wave Advisor service, Wave promises to handle your bookkeeping for you, using their free cloud-based accounting software. While pricing starts at $149 per month, it may be difficult to predict how much Wave bookkeeping will cost your business. There are no publically available types of audit reports you can issue besides unqualified pricing tiers—you’ll have to book a call with Wave to get a quote. A lot of virtual bookkeepers use accounting software like Xero or QuickBooks Online. Both are easy to navigate for bookkeepers and accountants alike but require some learning for the typical small business owner.

Every virtual bookkeeping service should have an option that includes this. It might (and it should) cost more than their basic level, but the option should be there. In our evaluation of 1-800Accountant’s Enterprise plan, it took a hit in pricing because it charges $399 a month, which is more expensive than many of its competitors. Although it offers https://www.business-accounting.net/how-to-price-a-bond/ a dedicated bookkeeper and a number to call, it doesn’t offer video meetings or unlimited meetings, which is why it scored lower in the personal bookkeeper category. A good alternative is QuickBooks Live, which provides video meetings and unlimited meetings in general. Its low flat-rate fee and 100% money-back guarantee are also attractive features.

At Bench, for example, we connect directly to your bank and credit card accounts to automatically pull your transactions. Then we categorize every transaction and produce shiny financial statements for you. We also give you an easy-to-use platform with simple reports and dashboards to keep track of your finances. Every business, from the biggest corporations to pre-revenue startups, benefits from bookkeeping.

However, Ignite Spot doesn’t list its virtual accounting prices upfront. You have to enter more information about your needs to get a quote—which is useful if you want truly customized services but unhelpful if you’d rather choose a basic plan out of a lineup. It also starts at $190 a month, which is less than nearly every other provider on our list. As an insider in the cloud accounting world, I can tell you that many https://www.kelleysbookkeeping.com/ don’t follow the best practices that have been listed above.

- However, it doesn’t offer sales tax return filing and chief financial officer (CFO) advice.

- We consider the opinions of users and the service’s ratings on various review sites.

- Because bookkeeping is going to cost you no matter how you take care of it.

- Look for signs of these traits, like a clean website or an efficient email response.

- They must offer flat rate pricing — a monthly fee in exchange for a well-defined set of deliverables.

When you work with Ignite Spot Accounting, you’ll get bookkeepers certified in a variety of popular programs, such as QuickBooks and TSheets. If you choose its chief financial officer (CFO) services, your CFO will be a certified public accountant (CPA) at a minimum. Its features include automation of tasks, Gusto payroll processing, balance sheet production, income statements, accuracy checks and transaction databases. The leading online bookkeeping services offer many levels of security. Virtual bookkeeping lets a bookkeeper or accountant remotely provide services for a client. At Goodbooks we use bookkeeping software (Xero, Quickbooks Online) to review and update financial statements, post financial transactions, and reconcile accounts.

With Expert Full-Service Bookkeeping we pair you with a dedicated bookkeeper who will bring your books up to date and then manage your monthly books for you, so you can focus on your business. First, you will be set up in one of our two softwares which suits your business best. Once registered, we will set up a “bank feed” which automatically and securely uploads your bank statements to the software and we can begin our job! You will provide any receipts, invoices or bills either through an electronic document collector (Hubdoc) or you may also upload receipts from a mobile device right onto the software. You will have 24/7 access to your books and the surety that they are safe and secure.

In the area of tax and consulting, its Premium plan will file your annual tax return and provide tax advisory services. However, it doesn’t offer sales tax return filing and chief financial officer (CFO) advice. It also lacks a couple of important bookkeeping features, including full-service payroll and paying bills. Although it will assist with tracking accounts receivable, that excludes invoicing customers.

Compound Interest Rate Calculator

If 30 years is too long, you can use this information to decide to increase your initial investment or find another investment that has a higher interest rate. The Rule of 72 is a shortcut to determine how long it will take for a specific amount of money to double given https://www.online-accounting.net/what-is-an-audit/ a fixed return rate that compounds annually. One can use it for any investment as long as it involves a fixed rate with compound interest in a reasonable range. Simply divide the number 72 by the annual rate of return to determine how many years it will take to double.

Example 4 – Calculating the doubling time of an investment using the compound interest formula

Note that when doing calculations, you must be very careful with your rounding. For standard calculations, six digits after the decimal point should be enough. Many of the features in my compound interest calculator have come as a result of user feedback,so if you have any comments or suggestions, I would love to hear from you.

Sales & Investments Calculators

Compound interest is defined as the interest earned on a loan or investment that comes from both the initial principal and the accumulated interest. A compound interest calculator can help individuals estimate how much they need to save regularly to reach their retirement goals and ensure a comfortable financial future. You can use this tool to make informed decisions about your investments or loans by understanding how compound interest affects the overall growth or cost over time. For example, $100 with a fixed rate of return of 8% will take approximately nine (72 / 8) years to grow to $200. Bear in mind that “8” denotes 8%, and users should avoid converting it to decimal form.

Example 2 – complex calculation of the value of an investment

This means your investment grows faster compared to simple interest, where interest is calculated only on the principal amount. Understanding this concept is crucial for anyone looking to maximize their financial growth. This formula can help you work out the yearly interest rate you’re getting on your savings, investment or loan. Note that youshould multiply your result by 100 to get a percentage figure (%). The effective interest rate (or effective annual rate) is the rate that gets paid after all the compounding. When compounding of interest takes place, the effective annual rate becomes higher than the overall interest rate.

The value of the investment after 10 years can be calculated as follows… The interest rates of savings accounts and Certificate of Deposits (CD) tend to compound annually. Mortgage loans, home equity loans, and credit card accounts usually compound monthly. https://www.online-accounting.net/ Also, an interest rate compounded more frequently tends to appear lower. For this reason, lenders often like to present interest rates compounded monthly instead of annually. For example, a 6% mortgage interest rate amounts to a monthly 0.5% interest rate.

How do compounding intervals affect interest earned?

Should you need any help with checking your calculations, please make use of our popular compound interestcalculator and daily compounding calculator. This formula is useful if you want to work backwards and calculate how much your starting balance would need to be in order to achieve a future monetary value. Now that we’ve looked at how to use the formula for simple petty cash book format example calculations in Excel, let’s go through a step-by-step example to demonstrate how to make a manualcalculation using the formula… It will help to calculate how much principal needs to be invested to earn a certain amount of interest. If you want to make $5,000 in interest over the next 5 years, this calculation will tell you how much you need to invest.

The most common real-life application of the compound interest formula is a regular savings calculation. If an amount of $10,000 is deposited into a savings account at an annual interest rate of 3%, compounded monthly, the value of the investment after 10 years can be calculated as follows… Most financial advisors will tell you that compound frequency is the number of compounding periods in a year. In other words, compounding frequency is the time period after which the interest will be calculated on top of the initial amount. In general, for savings accounts, interest can be compounded at either the start or the end of the compounding period (this is usually every month or every year). If additional contributions are included in your calculation, the compound interest calculator will assume that these contributions are made at the start of each period.

Note that the greater the compounding frequency is, the greater the final balance. However, even when the frequency is unusually high, the final value can’t rise above a particular limit. If you’rereceiving 6% then your money will double in about 12 years.

However, we’ll break it down so you have a good understanding of how the calculator works. Total Deposits – The total number of deposits made into the investment over the number of years to grow. Annual Interest Rate (ROI) – The annual percentage interest rate your money earns if deposited. When it comes to retirement planning, there are only 4 paths you can choose. Our flagship wealth planning course teaches you how to secure your financial future with certainty.

- We’ll assume you intend to leave the investment untouched for 20 years.

- The results of this calculator are shown in future value of the money.

- Our online calculator simplifies this concept, turning complex calculations into easy-to-understand results.

- The more times the interest is compounded within the year, the higher the effective annual rate will be.

The more times theinterest is compounded within the year, the higher the effective annual interest rate will be. This formula will show you what interest rate is needed to reach a particular final goal. If you plan to get $15,000 in 10 years, you need to know how much interest you will need to earn if you invest $5,000. In this example, the calculator will show you that (compounded monthly), you will need to find an investment that earns at least 11% per year. Note, that if you leave the initial and final balances unchanged, a higher the compounding frequency will require a lower interest rate. This is because a higher compounding frequency implies more substantial growth on your balance, which means you need a lower rate to reach the same amount of total interest.

You can use it to calculatehow long it might take you to reach your savings target, based upon an initial balance and interest rate. Youcan see how this formula was worked out by reading this explanation on algebra.com. Start by multiply your initial balance by one plus the annual interest rate (expressed as a decimal) divided by the number of compounds per year.

This compounding effect causes investments to grow fasterover time, much like a snowball gaining size as it rolls downhill. Here’s how different compounding period intervals are affecting the total amount generated and interest earned. This is because rate at which compound interest grows depends on the compounding frequency, such that the higher the compounding frequency, the greater the compound interest. Compound interest occurs when interest is added to the original deposit – or principal – which results in interest earning interest. Financial institutions often offer compound interest on deposits, compounding on a regular basis – usually monthly or annually.

Please feel free to share any thoughts in the comments section below. I’ve received a lot of requests over the years to provide a formula for compound interest with monthly contributions. The results of this calculator are shown in future value of the money. If you turn on the “Inflation (%)” option, then you can also see the adjusted for inflation value as well. You can how over the chart bars to see individual metrics for any of the calculated yearly time series. Future Value – The value of your account, including interest earned, after the number of years to grow.

While compound interest grows wealth effectively, it can also work against debtholders. This is why one can also describe compound interest as a double-edged sword. Putting off or prolonging outstanding debt can dramatically increase the total interest owed. Tibor Pál, a PhD in Statistical Methods in Economics with a proven track record in financial analysis, has applied his extensive knowledge to develop the compound interest calculator. The depreciation calculator enables you to use three different methods to estimate how fast the value of your asset decreases over time.

Compound Interest Calculator Daily, Monthly, Yearly Compounding

The compounding of interest grows your investment without any further deposits, although you may certainly choose to make more deposits over time – increasing efficacy of compound interest. It helps individuals make informed decisions about investing, borrowing, and planning for the future by providing accurate projections of how money will grow or diminish over time. Your initial investement of plus your investment of at an annualized interest rate of will be worth after when compounded . For other compounding frequencies (such as monthly, weekly, or daily), prospective depositors should refer to the formula below.

Yes, email me a screenshot of my calculator results!

The easiest way to take advantage of compound interest is to start saving! You may choose to set the frequency as continuous, which is a theoretical price to tangible book value definition limit of recurrence of interest capitalization. In this case, interest compounds every moment, so the accumulated interest reaches its maximum value.

- Note that when doing calculations, you must be very careful with your rounding.

- Our calculator stands out due to its accuracy, ease of use, and the option to download results.

- This means total interest of $16,532.98 anda return on investment of 165%.

- With your new knowledge of how the world of financial calculations looked before Omni Calculator, do you enjoy our tool?

- The compound interest formula is an equation that lets you estimate how much you will earn with your savings account.

Compound Interest Formula

Compound interest tables were used every day before the era of calculators, personal computers, spreadsheets, and unbelievable solutions provided by Omni Calculator 😂. The tables were designed to make the financial calculations simpler and faster (yes, really…). You should know that simple interest is something different than the compound interest. On the other hand, compound interest is the interest on the initial principal plus the interest which has been accumulated. Enter your principal amount, interest rate, and investment duration. Experiment with different variables to see how changes affect your potential earnings.

Invest Like Todd!

While simple interest only earns interest on the initial balance, compound interest earns interest on both the initial balance and the interest accumulated from previous periods. Compound interest is a type of interest that’s calculated from both the initial balance and the interest accumulated from prior periods. If you want to find out how long it would take for something to increase by n%, you can use our rule of 72 calculator. This tool enables you to check how much time you need to double your investment even quicker than the compound interest rate calculator. Whether for personal savings, retirement planning, or educational investments, this calculator offers the foresight needed to make informed financial decisions.

Interest rate definition

As you compare the compound interest line tothose for standard interest and no interest at all, you can see how compounding boosts the investment value. Compound interest is calculated by multiplying the initial principal amount by one plus the annual interest rate raised to the number of compound periods minus one. Compound interest (or compounding interest) is interest calculated on the initial principal, which also includes all the accumulated interest of previous periods of a deposit. Long-term investing can be a great way to save for your future.Use our compound interest calculator to see how your investments will grow over time. Compound interest is an important concept to understand that is widely used in investing, finance, and banking.

“Unlock the magic of compound interest – your money’s superpower! 🚀 Ever heard of the time value of money? It’s the game-changer that shows why starting early is so important. Your money grows faster, works harder, and creates a financial snowball effect. N is the number of times that interest is compounded per unit t (usually, n is the number of times per year). Here you can set how often the interest is added to (capitalized on) your balance (principal). Historically, rulers regarded simple interest as legal in most cases.

Note that in the case where you make a deposit into a bank (e.g., put money in your savings account), you have, from a financial perspective, lent money to the bank. You may, for example, want to include regular deposits whilst also withdrawing a percentage for taxation reporting purposes. Or,you may be considering retirement and wondering how long your money might last with regular withdrawals.

The compound interest formula is an equation that lets you estimate how much you will earn with your savings account. It’s quite complex because it takes into consideration not only the annual interest rate and the number of years but also the number of times the interest is compounded per year. Welcome to the world of financial growth, where understanding compound daily interest https://www.kelleysbookkeeping.com/gross-income-vs-net-income/ can unlock your investment potential. Our online calculator simplifies this concept, turning complex calculations into easy-to-understand results. Whether you’re a seasoned investor or just starting, this tool is designed to enhance your financial planning. Experience the ease of obtaining precise calculations and the convenience of downloading results in PDF or XLS formats.

Ancient texts provide evidence that two of the earliest civilizations in human history, the Babylonians and Sumerians, first used compound interest about 4400 years ago. However, their application of compound interest differed significantly from the methods used widely today. In their application, 20% of the principal amount was accumulated until the interest equaled the principal, and they would then add it to the principal. The following examples are there to try and help you answer these questions. We believe that after studying them, you won’t have any trouble with understanding and practical implementation of compound interest.

Read on to learn more about the magic of compound interest and how it’s calculated. Let’s cover some frequently asked questions about our compound interest calculator. Calculate percentage additions and deductions with our handy calculator. If you have any problems using our calculator tool, please contact us. I think it’s worth taking a moment to mention the monetary gain that interest compounding can offer. Number of Years to Grow – The number of years the investment will be held.

However, certain societies did not grant the same legality to compound interest, which they labeled usury. For example, Roman law condemned compound interest, and both Christian and Islamic texts described it as a sin. Nevertheless, lenders have used compound interest since medieval times, and it gained wider use with the creation of compound interest tables in the 1600s.

To understand the math behind this, check out our natural logarithm calculator, in particular the The natural logarithm and the common logarithm section. Therefore, the more often the interest is added to (capitalized on) the principal amount, the faster your balance grows. As shown by the examples, the shorter the compounding frequency, the higher the interest earned. However, above a specific compounding frequency, depositors only make marginal gains, particularly on smaller amounts of principal. Because lenders earn interest on interest, earnings compound over time like an exponentially growing snowball.

In this example you earned $1,000 out of the initial investment of $2,000 within the six years, meaning that your annual rate was equal to 6.9913%. You can use the compound interest equation to find the value of an investment after a specified period or estimate the rate you have earned when buying and selling some investments. It also allows you to answer some other questions, such as how long it will take to double your investment.

While most people will use the default formula to calculate the expected result of compound interest, several other formulas are available. Compound interest has dramatic positive effects on savings and investments. Interest is the cost of using borrowed money, or more specifically, the amount a lender receives for advancing money to a borrower. When paying interest, the borrower will mostly pay a percentage of the principal (the borrowed amount).

The rule of 72 helps you estimate the number of years it will take to double your money. The method issimple – just divide the number 72 by your annual interest rate. The TWR figure represents the cumulative growth rate of your investment. It is https://www.business-accounting.net/ calculated by breaking out each period’s growth individually to remove the effects of any additional deposits and withdrawals. When interest compounding takes place, the effective annual rate becomes higher than the nominal annual interest rate.

14 E-Commerce Email Marketing Tips to Grow Your Business

Pricing varies based on the level you choose, which depends mostly on your sales volume. Intuit QuickBooks Online’s powerful, cloud-based accounting solution helps businesses of all sizes manage their finances. It’s one of the highest-rated and most popular bookkeeping software services — and for good reason. Few accounting software programs are as fully featured as QuickBooks Online, what is depreciation definition formulas and types which lets users track expenses, reconcile bank accounts, generate critical financial reports and much more. QuickBooks Plus is the most popular plan for businesses since it includes features such as inventory tracking, project management and tax support. Midsized businesses with several customers or clients might benefit from the ability to track profitability with QuickBooks Plus.

Best QuickBooks Online Ecommerce Integrations At a Glance

You can also use Shopify for point-of sale hardware and software to facilitate in-person sales. Running a retail business comes with a lot of work, including such duties as inventory management, invoicing, and online payroll services for your staff, so freeing up time is a huge benefit. Converting to an automated system also minimizes the risk of human error that comes with manual entry of information. The overall increase in efficiency and accuracy ultimately saves you money and allows your company to grow faster. But selling online is a complex business, and though there’s a glut of platforms such as Shopify that enable anyone to create an online store with ease, other aspects have been left behind. Notably, the accounting process for online retailers has been neglected, with most smaller businesses and individual sellers using tools such as Quickbooks, Xero and NetSuite.

Create a TechRepublic Account

- Need help integrating Quickbooks Commerce with your 3dCart ecommerce platform?

- With these website builders, you can create a customized, branded storefront connected to back-end functions such as accounting, order management, inventory management, and customer service.

- You can increase visibility and enable shopping directly through channels like Pinterest and Instagram.

- All of the other software in this guide acts as an intermediary between QuickBooks and Shopify, versus providing a direct link, like Shopify Connector by QuickBooks.

You can send unlimited invoices to customers and keep track of your accounts at no cost—making it our best free accounting software. It allows you to complete various tasks, such as the ability to create and send invoices and accept payments from your smartphone. On the flip side, QuickBooks is less competitive in terms of pricing when compared to the other software on our list.

Integrations

QuickBooks is in the business of creating smart, indispensable financial tools that help small businesses reach solvency and achieve prosperity. Integrating your ecommerce platform with QuickBooks Online lets you transfer your sales data automatically to QuickBooks Online for accounting purposes. It also helps automate various tasks, such as invoicing, payment reconciliation, and inventory management. It gets the job done and allows you to manage sales and inventory across multiple sales channels. The big thing that sets it apart from other platforms is its low price (starting at $55 per month) and its home in QuickBooks Online. QuickBooks Commerce is unparalleled in its accounting features because it’s built out of QuickBooks Online software.

The platform simplifies selling with integrated inventory management, SEO tools, and integrated payment options. If you’re familiar with WordPress or already have a WordPress site for your business, this e-commerce platform may be a smooth move. Customers can purchase directly from your e-commerce store online as well as through other online marketplaces and social media.

Why Your Business Needs Ecommerce Accounting Software

As a business grows, users can easily upgrade to a more advanced plan with additional features seamlessly. QuickBooks is the platform most used by professional accountants so if you plan to work with an accountant, they will likely be very familiar https://www.accountingcoaching.online/are-purchases-treated-as-assets-or-expenses/ with the platform, its features and capabilities. There are more than 750 QuickBooks Online integrations available across various categories such as payment processing, CRM, ecommerce, inventory management, time tracking, and more.

The downside of using one of the premade e-commerce storefronts listed above is that you wind up paying fees to the platform in perpetuity. Plus, you have relatively little customization capabilities over the store’s appearance and functionality. The platform owner may make changes that you aren’t happy with, and some modules of the platform may work better than others. If remote life has taught us anything, it’s that online shopping isn’t going anywhere. You can do it in your sweatpants, from almost any device, and at any time of day. Accounting software will also help you plan for growth and manage your cash flow.

The best QuickBooks Online integrations depend on your unique business needs and circumstances. For instance, if you need to manage sales pipeline and lead tracking, you may integrate QuickBooks Online with a customer relationship management (CRM) software like Pipeline CRM. If you run a retail store, you may consider a QuickBooks Online and Square POS integration.

As we continue our journey to build a more durable integrated product to help our customers grow their businesses, we continue to develop commerce accounting capabilities into QuickBooks Online worldwide. “Every online seller needs to do accounting, both from a compliance perspective and a business visibility perspective,” he said. Typically, small e-commerce companies will either manage their own bookkeeping or work with a third party to carry this out.

With 100 million customers worldwide using TurboTax, Credit Karma, QuickBooks, and Mailchimp, we believe that everyone should have the opportunity to prosper. We never stop working to find new, innovative ways to make that possible. Please visit us at Intuit.com and find us on social for the latest information about Intuit and our products and services. This information is intended to outline our general product direction, but represents no obligation and should not be relied on in making a purchasing decision. Additional terms, conditions and fees may apply with certain features and functionality.

If you’re looking for a QuickBooks integration for other business ventures, see our roundup of the best QuickBooks Online integrations for small businesses. The integration also transfers customer data, such as purchase history and contact information, from CS-Cart Multi-Vendor to QuickBooks Online. This can help vendors improve their marketing strategies and customer engagement.

Businesses that provide services, rather than goods, should consider the QuickBooks Essentials plan. Businesses with inventory will likely get the most benefit from QuickBooks Plus. Large businesses that need access for up to 25 users https://www.simple-accounting.org/ will probably want to go with QuickBooks Advanced. The steps involved in integrating QuickBooks with an e-commerce platform include selecting an integration solution, setting up the integration, and testing the integration.

Terms, conditions, features, service and support options are subject to change without notice. Active subscription, Internet access, Federal Employer Identification Number (FEIN), and U.S. billing address required. Webgility is a powerful integration solution that connects Shopify with both QuickBooks Online and QuickBooks Desktop.

Accrual accounting is an accounting method that records financial transactions when they are incurred, rather than when cash is exchanged. The first step in setting up your e-commerce accounting is to pick an accounting system. The two main options you have are cash accounting and accrual accounting.

The platform also has built-in blogging to add a content component that helps you connect with customers. When you establish these different audiences, you can then create custom content tailored to their needs. You might send your VIP customers additional bonuses or rewards or you might market more expensive products to customers with a higher-value purchase history. If you’re looking for ways to improve your outreach and boost sales, consider e-commerce email marketing. According to a 2023 survey by Litmus, an astounding 41% of marketers said that email marketing is their most effective channel, beating out both social media and paid search.

Best Shopify Integrations for QuickBooks in 2024

For one thing, it limits the number of invoices its customers can send each month to 20 with the cheapest plan. The lowest-tier plan users are also limited to managing just five bills a month and creating 20 estimates a month. QuickBooks Online syncs with more than 750 different third-party business apps, ranging from point-of-sale apps to payment acceptance tools and beyond. Naturally, QuickBooks Online syncs with other QuickBooks products as well, including QuickBooks Time (formerly TimeTrex), TurboTax and QuickBooks Online Payroll.

Common Challenges of Integrating QuickBooks with Your E-commerce Platform

This includes past sales transactions, customer information, and product details, ensuring a complete record in QuickBooks Online. Katana, primarily an enterprise resource planning (ERP) system for manufacturing companies, is affordable—even for small manufacturing companies. To manage payroll through QuickBooks Payroll, you’ll need to pay a fee for this add-on service, with plans ranging from $45 to $125 per month, plus an additional $5 to $10 per employee per month. If you are a small business or a startup, consider QuickBooks Simple Start.

Income and expense tracking with QuickBooks Online

You can choose from a handful of free themes or paid themes to get a look you like. BigCommerce is a popular e-commerce platform that works for both small and large online retailers. With many customization options available, you can create a store that matches your brand. If you don’t have a lot of tech experience, BigCommerce may be a good match for you. Inventory and order management features let you better serve your customers.

e-commerce trends small businesses should know about

The ROI for e-commerce email marketing is roughly $44 for every $1 spent. That’s far higher than the ROIs for both paid advertising and e-commerce search engine optimization (SEO), which sit at $2 for every $1 spent and $2.75 for every $1 spent, respectively. That doesn’t mean you should pour every marketing dollar you have into email, but it does mean you should shift more of your focus toward it. Everything you need to start, run, and grow your e-commerce business. Danielle Bauter is a writer for the Accounting division of Fit Small Business.

- Finaloop aims to transform e-commerce accounting with its highly automated bookkeeping platform that runs in the background, keeping track of three separate business functions.

- QuickBooks Online is a cloud-based accounting software that helps you manage different aspects of your business, such as invoicing, income and expense tracking, and reporting.

- The first step in setting up your e-commerce accounting is to pick an accounting system.

- There is also a Pro option that Intuit offers to enterprise-level businesses, but you’d have to call and speak with the team for pricing and features.

- The platform also has built-in blogging to add a content component that helps you connect with customers.

Unless you’re willing to use Zapier, you must purchase additional Zoho services, such as Zoho Inventory, which ranges from $0 to $329 monthly, or Zoho Flows, which ranges from $12 to $30 monthly. The best accounting method for an online business depends on its size, complexity, and specific needs. Expert Assisted is a monthly subscription service that requires a QBO subscription and provides expert help to answer your questions related to the books that you maintain full ownership and control. An expert can guide you through QBO setup and answer questions based on the information you provide; some bookkeeping services may not be included and determined by the expert. For more information about Expert Assisted, refer to the QuickBooks Terms of Service. We’re focused on integrating QuickBooks Commerce and QuickBooks Online as a central platform beginning with our US-based customers.

A big part of that is assessing financial statements, such as the balance sheet, profit and loss statement, and cash flow statement. To nail it, you’ll also need to focus on how your site is built, how images are tagged, and what data is scraped by search bots, like Google. You can increase visibility and enable shopping directly through channels like Pinterest and Instagram. Twitter and Facebook are valuable promotion channels that allow people to spread the word about your brand. With online retail bigger than ever, there are a few important things to know to help you achieve success as a small business owner.

Your entire business depends on lasting, quality customer relationships. The features and tools offered for your business’s customer relationships are crucial to your success and growth. The Quickbooks income tax expense Commerce inventory and manufacturing management interface is incredibly convenient and easy to use, and it’ll keep track of all the complicated backend processes, so you don’t have to.

QuickBooks offers more — and better — reports than nearly any other accounting software provider. With the Simple Start plan, QuickBooks’ software will generate cash flow statements, income statements and balance sheets. Users can also use it to create customized tags and reports that help you hone in on specific income and expense trends and up your business’s cash flow.

This ensures accurate and up-to-date financial records in QuickBooks Online. Today’s leading accounting platforms offer standard security features like data encryption, secure credential tokenization and more. While human error https://www.business-accounting.net/the-advantages-disadvantages-of-a-multiple/ will always play some role in security breaches, you can be confident in your accounting platform when it comes to keeping your information safe. Once your accounts are connected, you will need to set up your chart of accounts.

Kristy Snyder is a freelance writer and editor with 12 years of experience, currently contributing to the Forbes Advisor Small Business vertical. She uses her experience managing her own successful small business to write articles about software, small business tools, loans, credit cards and online banking. Kristy’s work also appears in Newsweek and Fortune, focusing on personal finance. Research shows that 64% of small businesses are using email marketing to reach customers. To review QuickBooks Online, we set up a free online account with a demo business so we could test the software for ourselves. We also carefully read through individual user reviews on sites like Gartner Peer Insights and Trustpilot to ensure we wrote a balanced, fair review that took multiple perspectives into account.

Additionally, if you pre-pay for an entire year of services, you’ll get your plan of choice at a discounted rate. Luckily, Intuit has released its Quickbooks Commerce platform, making data inventory management a streamlined and simplified process for small business owners. Terms, conditions, pricing, https://www.accountingcoaching.online/ subscriptions, packages, features, service and support options are subject to change at any time without notice. Shopify Connector by QuickBooks, which tops our list of the best Shopify integrations for QuickBooks, provides a free, direct connection between Shopify and QuickBooks Online.

Net Accounts Receivable: Aging of Receivables Method Video Tutorials & Practice Problems

The credit department may review the invoices that have been paid by using the aging report. The company’s auditors may use the report to select invoices for issue confirmations as part of their year-ending audit activities. Accounts receivable aging is a periodic report that categorizes a company’s accounts receivable according to the length of time an invoice has been outstanding. It is used as a gauge to determine the financial health and reliability of a company’s customers. In the following table, the accounts receivable have been grouped by periods of 20 days. The probability of a customer defaulting have also been given against each age group.

Accounts Receivable Aging Report

You can then avoid sending goods and services to customers before late payments become an issue and hamper cash flow. An accounts receivable aging report groups a business’s unpaid customer invoices by how long they have been outstanding. It helps estimate uncollectible receivables and can improve collections. Accounts receivable (AR) aging helps business aging accounts receivable method leaders monitor the status of open customer receivables and alerts accounting staff to follow up with the customer, increasing the likelihood of collecting payment. Bad debts are outstanding credit sales accounts that the business will not be able to collect. While these are a fact of life, businesses naturally want to avoid them whenever possible.

How do I create an AR aging report?

The distributor can then focus on collecting from customers in this category, implementing targeted collection strategies to improve cash flow and reduce the risk of bad debts. Additionally, the aging of accounts receivables will help you identify potential delays in the company’s cash flow. By uncovering potential credit risks, you can take preventative measures to protect yourself from more risky customers. AR aging is one of the most important business accounting reports, since it provides insights into the internal and external issues related to receivables that can help improve cash collection. AR aging helps identify customers with significant overdue balances allowing AR staff to prioritize collections efforts. But if John’s invoice was due on December 31, 2019, it would still appear in this column.

Global Payments

With accounting software, you’ll be able to generate accounts receivable aging reports. QuickBooks accounting software is extremely flexible, allowing you to customize customer settings to send invoices and reminders. This way, you can stay on top of customer payments and take action when needed. AR aging is a way of organizing outstanding receivables based on invoice due dates.

How Can I Improve the Accounts Receivable Aging?

Each bucket is assigned a percentage, based on the likelihood of payment. By multiplying the total receivables in each bucket by the assigned percentage, the company can estimate the expected amount of uncollectable receivables. The findings from accounts receivable aging reports may be improved in various ways.

DSO is related to a business’s working capital, and having a delayed collection can stir issues up with cash in A/R, which will eventually lead to liquidity issues. Companies using Accounts Receivable Aging are typically better off than those that do not. Customer payback can tell a lot about cash flow and financial health, along with benchmarks for the sales and communications departments to improve upon. Management uses aging to determine customer profiles regarding credit lending and payback periods. It is a common practice to use A/R aging to determine how much credit a company should lend its customers, just like a bank checks its customers’ credit scores and histories to determine loan eligibility.

How confident are you in your long term financial plan?

Use that 13% (along with your predictions for the other ranges) to calculate the estimated total amount that you won’t be able to collect from customers. An aging schedule is an accounting table that shows a company’s accounts receivables, ordered by their due dates. Often created by accounting software, an aging schedule can help a company see if https://www.bookstime.com/ its customers are paying on time. It’s a breakdown of receivables by the age of the outstanding invoice, along with the customer name and amount due. Unfortunately, it’s common for clients to be late with payment, either due to forgetfulness or other issues. When you make a lot of sales, it’s important to have a tool to keep track of receivables.

- If the same customers repeatedly show up as past due in an accounts receivable aging schedule, the company may need to re-evaluate whether to continue doing business with them.

- At any given time, most of your accounts receivable is in the or column.

- The interpretation could be that some customers are experiencing financial difficulties or may be a sign that the business is extending more credit to customers.

- Eventually, if payment isn’t received, the company’s accountants must write off the receivable as uncollectible, which hurts cash flow and earnings.

- If you are on QuickBooks, click on the reports tab on the left side of your screen, then search Accounts Receivable Aging.

- An AR aging schedule is a columnar report that shows the aging status of all open accounts receivable, usually as individual customer invoices.

Another example is when a shopper wants to buy that expensive pair of shoes now, but the paycheck kicks in only next month. The client gets the goods or services to fulfill the order and is informed when the due date is. Usually, a business gives a fixed default percentage on each date range.

Best Free Accounting Software for Small Businesses

Lastly, after applying the method, all the information is put into the A/R aging report. Once this report is complete, anyone can filter out the information they are looking for or take the report as a whole. This habit can be devastating in the long run as you may forget to bill customers or have any idea whether your customers have paid you. Customers will have no idea when to pay and may lose touch with your business afterward. Sandra Habiger is a Chartered Professional Accountant with a Bachelor’s Degree in Business Administration from the University of Washington. Sandra’s areas of focus include advising real estate agents, brokers, and investors.

Related AccountingTools Courses

Accounts receivable aging is useful in determining the allowance for doubtful accounts. When estimating the amount of bad debt to report on a company’s financial statements, the accounts receivable aging report is used to estimate the total amount to be written off. Let’s assume that a company’s Accounts Receivable has a debit balance of $89,400. However, there are a few customers’ invoices that are more than 60 days past due. Those past due accounts are reviewed closely and based on each customer’s information it is estimated that approximately $7,400 of the $89,400 will not be collected.

What is the aging method?

It involves dividing the balance in the Accounts Receivable account into age categories based on the length of time they have been outstanding. The above age groups may alternatively be labeled as “not yet due”, “20 days past due”, “40 days past due”, and “60 days past due”, respectively. It’s worth noting the reason we multiply by 360 days—as opposed to the year’s actual 365. Choosing 360 allows you to avoid overcomplicating your DSO with fractions. Whether or not your company calcululates with 360 or 365 is up to your discretion. As the age of receivables increases, it worsens for the company because it is unlikely they will get paid.

Small business

These may be sold to collections, pursued in court, or simply written off. The second reason is so that the company can calculate the number of accounts for which it does not expect to receive payment. Using the allowance method, the company uses these estimates to include expected losses in its financial statement. Accounts receivable aging sorts the list of open accounts in order of their payment status. There are separate buckets for accounts that are current, those that are past due less than 30 days, 60 days, and so on. Based on the percentage of accounts that are more than 180 days old, a company can estimate the expected amount of unpaid accounts receivables for future write-offs.

Improve Collections With NetSuite

- It helps you to minimize uncollected debts, ensuring steady cash flow and identifying potential losses from clients.

- Use your aging schedule to help determine the percentage of customers who won’t pay.

- This refers to the amount of money a company expects to receive in exchange for the goods or services already provided to clients.

- This represents an asset to your business since you’ll be receiving payment in the future.

- Running the report prior to month-end billing includes fewer AR and shows little cash coming in, when, in reality, much cash is owed.

- If you are creating an A/R aging report on Excel, make columns and list out your customers’ names, the money they owe you on each date interval, and then a total column of all your outstanding balances.

Also, generating the report before the month ends will show fewer receivables whereas, in reality, there are more pending receivables. Management should match their credit terms to the periods of the aging reports to get an accurate presentation of the accounts receivable. The aging method is used aging accounts receivable method because it helps managers analyze individual accounts. This provides information which can be used to determine whether any further collection efforts are justified or not. The aging method also makes it easier for management to make changes in credit policies and discounts offered to customers.

Utilize Accounts Receivable Aging Reports To Optimize Cash Flow

Companies calculate their bad debt expense via either A/R aging or the percentage of sales method. To help you get started, we’re answering your common questions and addressing the basics of accounts receivable aging reports. As a result, it’s important that the company’s credit terms match the time periods on the report for an accurate representation of the company’s financial health. Company A typically has 1% bad debts on items in the 30-day period, 5% bad debts in the 31 to 60-day period, and 15% bad debts in the 61+ day period. The most recent aging report has $500,000 in the 30-day period, $200,000 in the 31 to 60-day period, and $50,000 in the 61+ day period.

Example of the Aging of Accounts Receivable and Bad Debts Expense

- The company’s management should generate aging reports monthly to know about the due invoices and notify customers accordingly.

- Let’s say John Melton’s $450 balance is all on one invoice, and that invoice was due on January 25, 2020.

- When you make a lot of sales, it’s important to have a tool to keep track of receivables.

- Alongside her accounting practice, Sandra is a Money and Life Coach for women in business.

- The probability of a customer defaulting have also been given against each age group.

- First, you’ll need to collect and organize all outstanding invoices from your accounts receivable.

We will have to use our BASE formula or T-account to calculate the Bad Debt Expense. For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. Maintaining a healthy cash flow could make the difference between success and failure; hence, underestimating the report’s importance can lead to bankruptcy. Invoice factoring may also be known as accounts receivable factoring and debt factoring. This impact could result in the inability to take advantage of seasonal opportunities, pay suppliers, make timely payments or pay liabilities.

How to use the accounts receivable aging report

- Typically, the company will approach the customer through email or other forms a few days before the due date.

- Then, place it in the appropriate category (e.g., 1-30 days past due, days past due, etc.).

- Aging is primarily used to help gauge the quality of a company’s receivables.

- The sum is now overdue for a period of more than 30 days but less than 60 days from the due date.

- As a business owner, the last thing you want is to sell your products or services and not get paid or be paid late.

Finally, in the bottom right corner, you should have all the money the company is waiting to collect. This method is called asset-based lending, which means that if the loan is not repaid, the lender can take the asset from the borrower. You need to know that the good or service received has been obtained on credit by the client.

To Identify Cash Flow Problems

The method used to estimate the desired balance in the allowance account is called the aging of accounts receivable. You may also want to adjust your credit policy by adding rules about interest. Adopting an interest policy may prevent customers from being too lax about paying their invoices. The bad debts expense https://www.bookstime.com/ is recorded in the income statement under the operating expenses section. If it is a fee, the agency gets paid irrespective of the outcome of their work. If it is a percentage, the collection agency is incentivized to succeed in collecting the payment because if they fail to do so, they don’t get paid.

Which of these is most important for your financial advisor to have?

The Generally Accepted Accounting Principles (GAAP) include procedures that are necessary for estimating, reporting, and eventually writing off bad debts in a company’s financial statements. The overdue payments are classified by the number of days passed since the due date, known as the age of receivables. Cash flow is important to a business because many businesses fail due to negative cash flow.